Activities

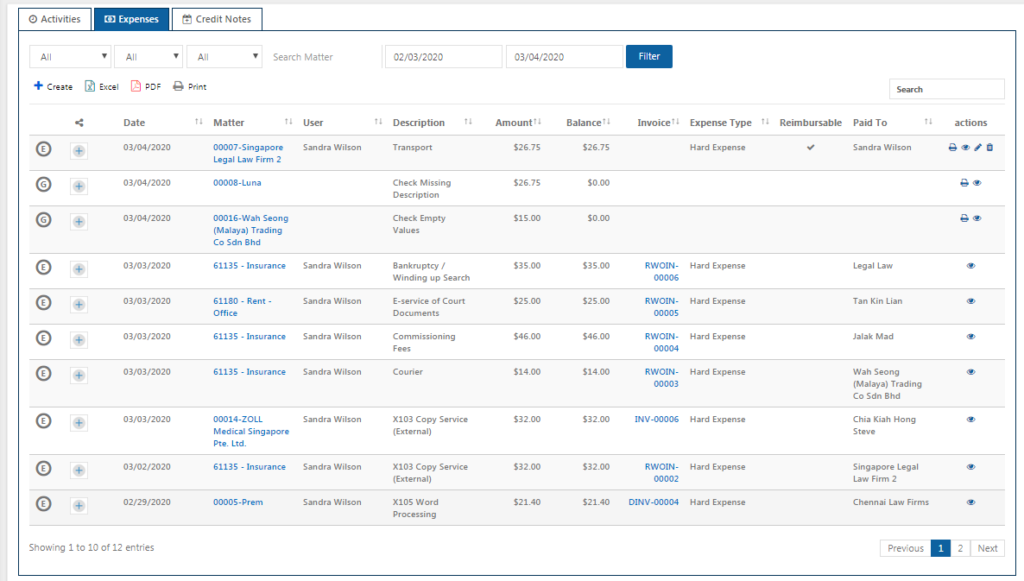

Clicking on the Activities & Expenses Tab displays a page like the below.

It has 3 tabs such as activities, expenses and credit notes.

The Activities tab displays the various activities created. To create a new activity, click on the ‘Add’ button.

The below page appears.

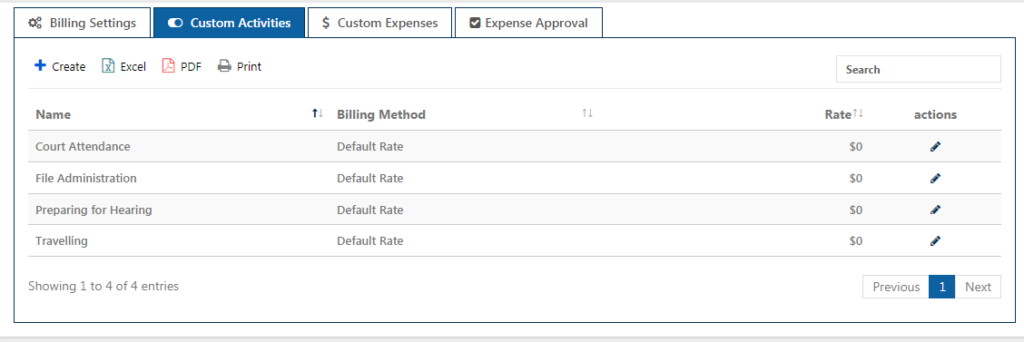

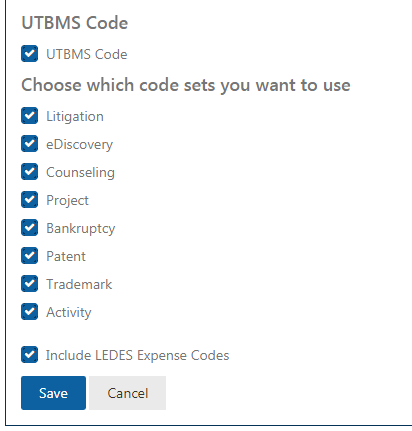

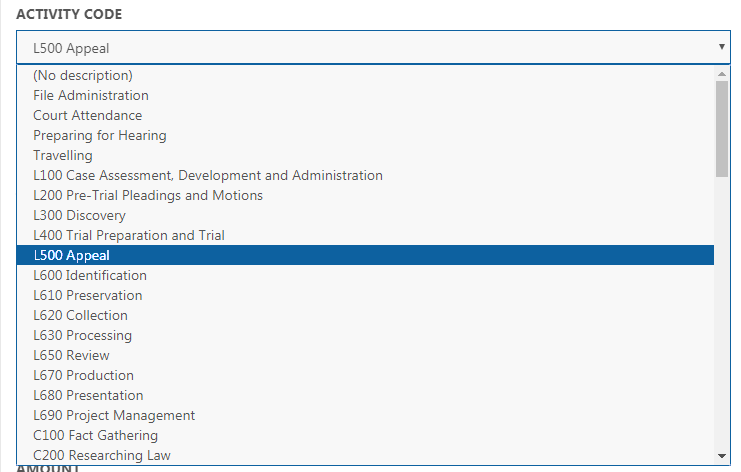

Enter the date and select the matter for which the activity is to be created. Fill the Fee Earner’s name and select the Activity Code from the drop-down list. The Activity Code listed contains the activities created through custom activities field of Billing Setting and the existing UTBMS Codes in Billing Settings.

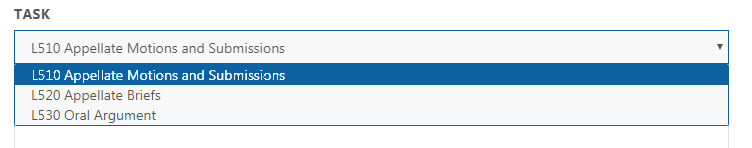

For the selected activity code, a list of tasks is shown. Choose a relevant task.

When the Time Entry option is chosen, select the time duration and enter an amount in the Rate field. This amount is the rate per hour. It is used to decide the final fee for the activity based on the time duration spent on the activity.

If Flat Fee is selected, time duration field is not used as the fee is fixed for each activity.

Select the appropriate GL Code and Tax Rate for the activity. Choose the Non-billable or Tax inclusive option as per the need and click ‘Save’. The activity will be created accordingly.